From Charts to Code: The Evolution of Technical Analysis in Trading

Written by Arbitrage • 2025-07-23 00:00:00

Despite the rise of AI, data science, and quant funds, technical analysis (TA) continues to thrive. More than half of all stock trading today is executed by machines - many of which rely on technical signals. What started as hand-drawn price charts in a newspaper has evolved into high-frequency strategies running across global markets. In this post, we'll walk through the history of technical analysis - from its ancient roots to its role in modern quantitative trading - and explore why it remains one of the most valuable skills a trader can develop.

1. The Origins: TA in the Early Days of Markets

The earliest known use of technical analysis traces back to 18th-century Japan, where rice traders developed candlestick charts to track market sentiment. These early techniques laid the groundwork for pattern recognition and emotional psychology in markets - concepts still central to TA today.

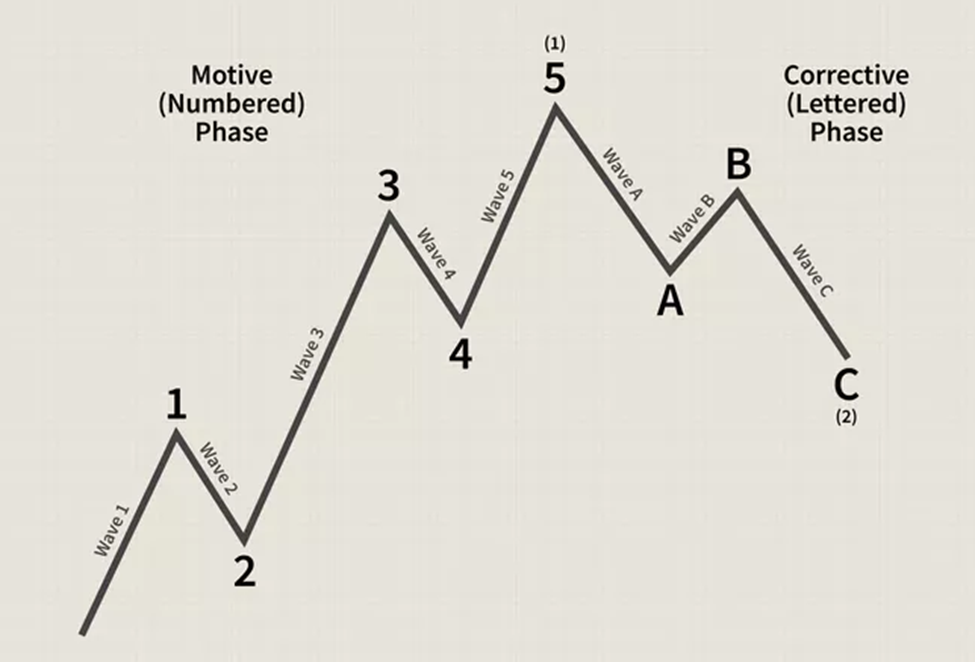

Fast forward to the late 1800s, and Charles Dow (the co-founder of the Wall Street Journal and Dow Jones & Company) formulated what would become known as Dow Theory. He proposed that market movements weren't random but followed identifiable trends and cycles. Though simple by today's standards, Dow's ideas gave birth to technical analysis in the Western world.

2. Mainstream Acceptance: TA in the 20th Century

In the mid-1900s, TA began to gain broader acceptance. Pioneers like Robert D. Edwards and John Magee published Technical Analysis of Stock Trends, one of the first books to formalize concepts like support, resistance, and chart patterns. Later, John Murphy's Technical Analysis of the Financial Markets helped bring TA to the masses, becoming a go-to reference for decades.

This period also saw the creation of technical indicators - mathematical formulas used to analyze price and volume. Tools like moving averages, RSI, MACD, and Bollinger Bands became staples on traders' screens. By the 1980s and '90s, desktop software brought these tools to retail traders for the first time.

3. The Quant Revolution: When TA Met Code

The early 2000s marked a turning point. Hedge funds like Renaissance Technologies, DE Shaw, and Two Sigma began deploying sophisticated algorithms that used technical data in ways human traders never could. Rather than interpreting chart patterns visually, these firms fed massive data sets into statistical models to uncover repeatable trading signals.

Technical indicators didn't disappear; they were just transformed. Moving averages became inputs in regression models. Breakouts were tested over thousands of historical scenarios. Indicators were no longer tools for decision-making, but variables in code. This was the rise of quantitative trading.

4. Today: TA in the Age of Algos and Retail Tech

Fast forward to today, and over 50% of stock trades are executed by computers. Many of these algorithms still rely on concepts pioneered by technical analysts - momentum, mean reversion, breakout confirmation - even if they don't look like traditional TA at first glance.

At the same time, retail traders have more access than ever. Platforms like TradingView, Thinkorswim, and custom indicators have brought TA tools once reserved for institutions into the hands of everyday traders. And unlike the past, today's traders can combine visual analysis with backtesting, probability models, and alerts.

5. Democratizing Sophistication: How Retail Traders Are Catching Up

At Arbitrage, we believe the edge should belong to everyone - not just the institutions. That's why we've built tools that incorporate probability, statistics, and momentum analysis into simple, easy-to-read indicators for all traders.

Our flagship system, the Arbitrage Band, is a modern evolution of the Bollinger Band - built to identify statistically significant shifts in trend before they happen. These are the same types of tools used by quant funds. The difference? We make them accessible.

You don't need a PhD in math to benefit from smart TA tools. You just need to understand what the data is telling you - and how to act on it.

6. The Future of TA

Looking ahead, technical analysis is likely to keep evolving. AI models may start identifying patterns humans can't even see. Charting platforms will get more advanced. But the essence of TA (reading the crowd, identifying behavior, understanding momentum) will remain.

Discretionary TA might never fully disappear. Instead, it will blend with automation and data science. The best traders of the future will be those who understand both sides: the art of reading a chart and the logic of testing a system.

Conclusion: A Timeless Skill in a Changing Market

Technical analysis has survived centuries of market evolution for one reason: it works. Not in the sense of a perfect prediction machine, but as a framework for understanding market behavior. From rice markets in Japan to the data centers of Wall Street, TA has always adapted. And today, with tools like Arbitrage, it's more accessible than ever.

Whether you're drawing lines or writing code, one truth remains: the charts are talking. The only question is: are you listening?