2025 Arbitrage Market Wrap - Part 1

Published on 12/17/20252025 Arbitrage Market Wrap: the 10 market-moving events that defined the year, and what they could mean for 2026.

What We’ll Eat and Drink in 2026

Published on 12/16/2025Predicted food and beverage trends for 2026 point toward a blend of wellness, nostalgia, and cultural authenticity, with consumers seeking both functional benefits and emotionally resonant flavors.

The Best Types of Gold to Buy: A Practical Guide for Smart Investors

Published on 12/15/2025How can you decide if gold is a good buy for you?

Embracing a Blank Canvas with Pantone’s Color of the Year

Published on 12/12/2025Picking the color of the year is never about fashionably pretty paint. It is about capturing a cultural mood, forecasting where design sensibilities might go next, and offering a shared "color language" for creativity worldwide.

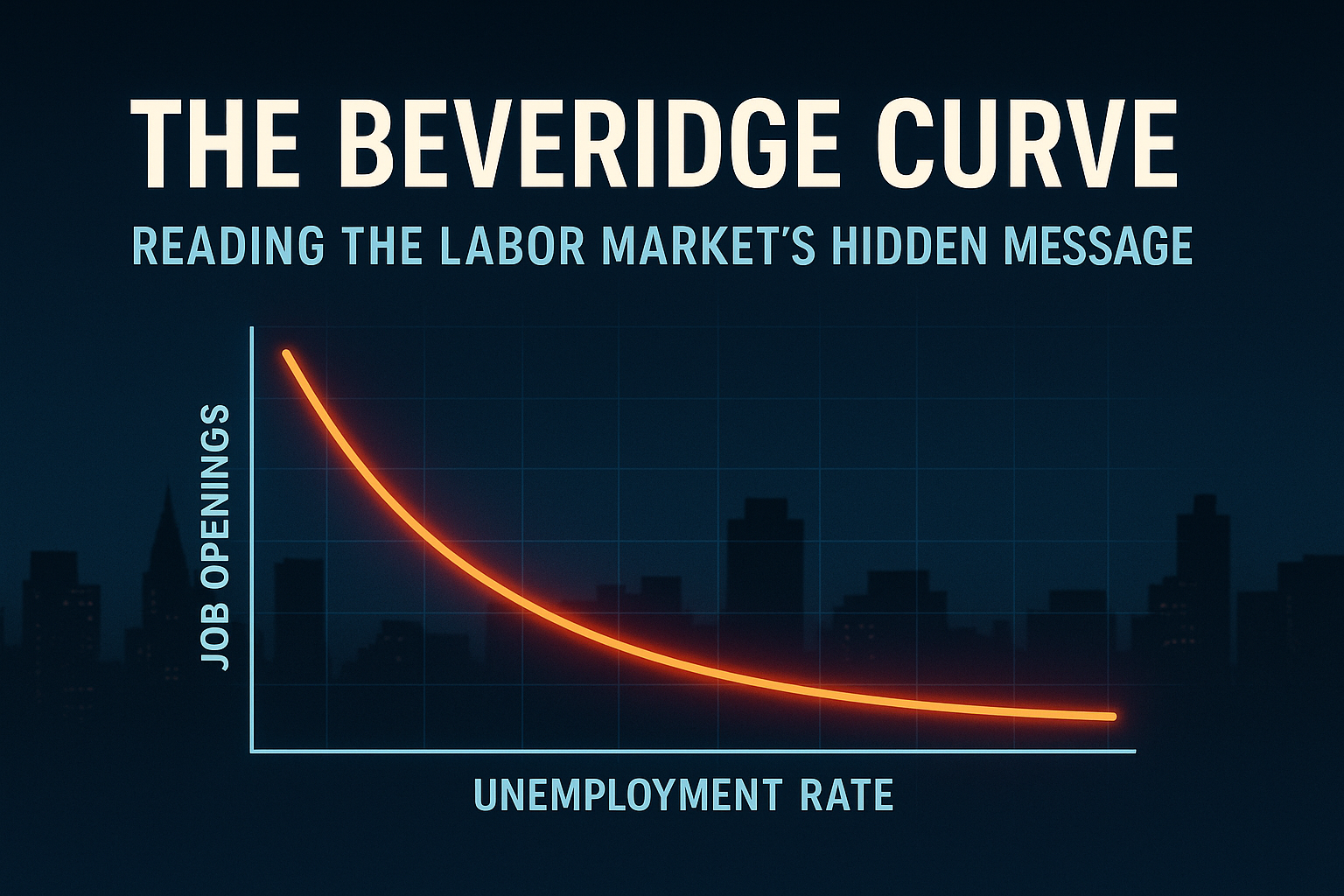

The Beveridge Curve: Reading the Labor Market’s Hidden Message - Part 2

Published on 12/11/2025The Beveridge Curve explains how vacancies and unemployment really move together. Learn what it reveals about labor market tightness, inflation, and the next macro regime.

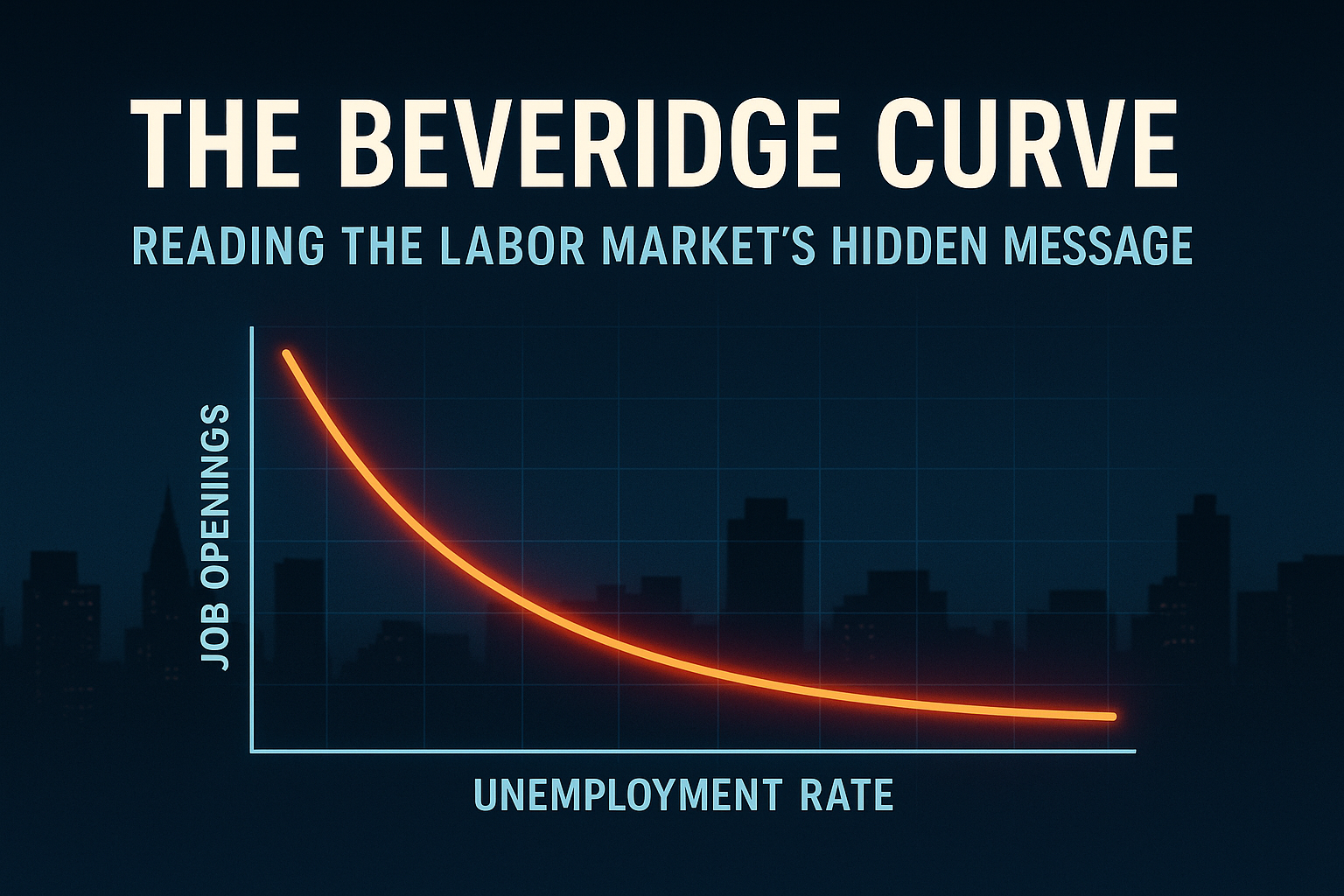

The Beveridge Curve: Reading the Labor Market’s Hidden Message - Part 1

Published on 12/10/2025The Beveridge Curve explains how vacancies and unemployment really move together. Learn what it reveals about labor market tightness, inflation, and the next macro regime.

The Gold Coins of St. Nicholas: A 1,700-Year-Old Lesson in Wealth Stewardship

Published on 12/09/2025What can we learn from the story of St. Nicholas and the gold coins?

The Gender Longevity Gap

Published on 12/08/2025Do women live longer than men?

Holiday Hosting Tips to Impress

Published on 12/05/2025With smart food choices, creative decor, and a relaxed hosting style, anyone can create a memorable and meaningful celebration.

Who Watches the Fed? The Myth of Independence and the Coming Reckoning - Part 2

Published on 12/04/2025Explore why the Federal Reserve’s independence is a myth, how politics have shaped its decisions, and what Japan’s central bank reveals about America’s future.

Who Watches the Fed? The Myth of Independence and the Coming Reckoning - Part 1

Published on 12/03/2025Explore why the Federal Reserve’s independence is a myth, how politics have shaped its decisions, and what Japan’s central bank reveals about America’s future.

Inside the GivingTuesday Movement

Published on 12/02/2025GivingTuesday’s mission is to unleash “the power of people and organizations to transform their communities and the world,” making generosity a shared global value.